Today I am posting a presentation I gave with my brother Tyler at the Value Investor’s Congress (VIC) on September 17, 2013; just over a year ago (53 weeks to the day to be exact). For those of you who are not familiar with this conference, it attracts some of the most skilled and experienced public market investors in the world. They are a skeptical bunch by training and we were fully expecting a tough crowd with hard-hitting questions. Our goal was to educate these investors on the origins of Bitcoin, the powerful implications of the protocol (decentralized, open-source, peer-to-peer) and its investment use-case as a long-term store of value.

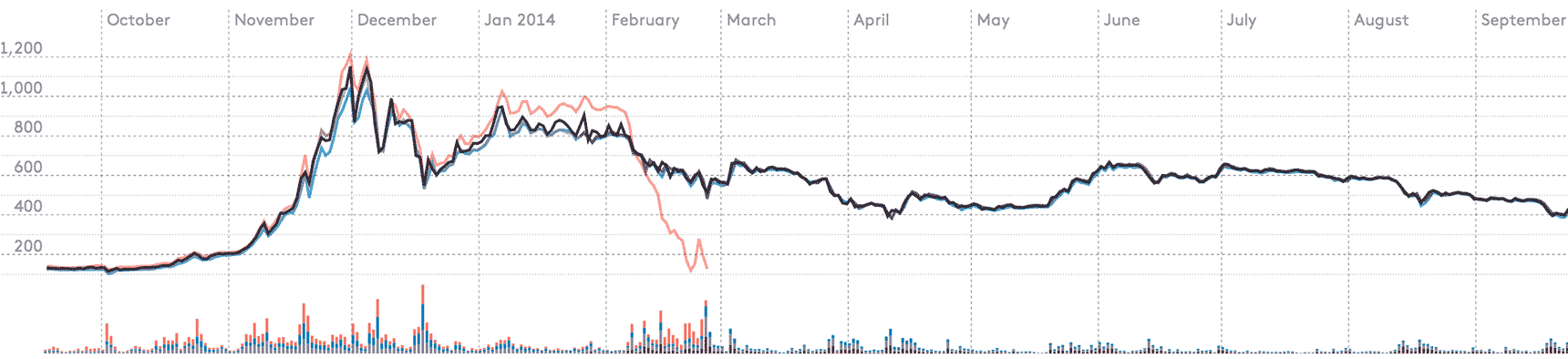

On the day of our presentation the price of Bitcoin was $132.27. Yesterday at 4pm EDT the price was $432.26. I generally don’t like to talk about price too much (admittedly breaking my own rule here), and as I’ve stated in my Reddit AMA. Most days I don’t check it at all, but in the context of this presentation and using the granularity of a year, I think it’s a reasonably worthy exercise. Rome wasn’t built in a day, and Bitcoin won’t be either, but I still feel very bullish about its long-term value both as a technology and an investment. Despite all the ups and downs of the past year, including the Silk Road bust (15 days after our presentation); a November price run above $1000 (which has since been called into question by the possible discovery of trading bots on Mt.Gox); the collapse of Mt.Gox in February 2014; pending regulation (most notably from the New York Department of Financial Services); and Paypal’s announcement yesterday to start integrating Bitcoin, the price is ~3-4x higher today.

Source: WinkDex.com. The orange line represents the price on Mt.Gox.

The price increase over the past year certainly bolsters the thesis of all long-term believers, but even if the price was the same as it was 53 weeks ago, I would be saying the same thing. I am a believer in this technology – I have yet to sell a single bitcoin and continue to invest in Bitcoin-related companies, develop our index and build our Bitcoin ETF.

Last week, I was asked on CNBC if I thought Apple Pay would compete with Bitcoin; I don’t. Aside from the obvious differences (closed vs. open system, centralized vs. decentralized, etc.) the bigger question IMO is whether things like credit cards and Apple Pay will ever reach the 2.5B unbanked adults (half the global population) in the world anytime soon. Will their sphere of operation grow beyond the 7-10 countries that they fully serve? Will they continue to lower the costs of transactions and sending/receiving money? Will they be able to handle micropayments or even contemplate nanopayments? Will they be able to integrate with autonomous agents? I believe the answer is and will continue to be No. It will be incumbent upon Bitcoin (or some new, yet to be developed protocol) to solve these problems going forward. If this coming year is anything like the last, expect big things from this innovation as the smartest minds in the room build applications and companies on top of and around the Bitcoin protocol.

*The quote on the regulatory slide has been updated, as well some some aesthetic improvements, however the content is the same as what we presented on September 17, 2013.

You guys are awesome.

Here here. It would be great if you did another AMA once you can publicly disclose more news on the ETF. Thank you for being such a strong supporter and doing your end to push Bitcoin forward.

https://goo.gl/pf5Xb6&ozjri

https://goo.gl/uGWmMz&ucohi

I don’t get why the Winkles get such shit. These guys are a 1,000x more eloquent at speaking, and 100x more confident than Zuckerturd. They’re sticking their necks out with Bitcoin, it takes a lot of courage.

Thanks guys

only because they are trying to jump on anything after they lost out to facebook

‘jump on anything’ ….They are very well connected, and know a lot of smart people. It’s not too hard to find out what the next great technological innovation will be, and invest in it. **rolls eyes**

yar they didnt jump on TWTR like i thought they should have

https://goo.gl/TfidKg&xjhi

https://goo.gl/TJfdSb&zjdj

https://goo.gl/YpBULn&yxoqu

https://goo.gl/RfTNrb&akjf

I would die laughing if ZUCK made a bitcoin etf before the Winklevoss’. Now thats a movie sequel I’d LOVE to see :P

https://goo.gl/ca24oG&xjzj

Amazing work!

https://goo.gl/UbBB5G&wjhim

Well done gentleman….Please get this ETF up and running asap as I know tih certainty the retail segment will jump all over it! Good luck guys!

https://goo.gl/LcCNQW&yzify

To be honest, I did not like the Winklevii after I watched the the facebook movie. I thought they extorted tens of millions (now worth hundreds of millions) from Facebook without deserving hardly any of it and still do. But given they are using those millions to push virtual currencies into the mainstream I can only say I am so glad those hundreds of millions moved from Zuck to the Winklevii and I hope they make Billions with a B on their virtual currency investments. And to diversify I’d like to encourage them to investigate Proof of Stake mining as it mines a coin without needing electricity like Bitcoin mining does. The Proof of Stake coin I’d recommend they also invest in is this one, http://www.vericoin.info as it’s also laying the groundwork for a world utilized currency and you don’t need tons of electricity and special miners to mine it.

https://goo.gl/ubZrX6&mate

awesome!!! well done guys!

https://goo.gl/9Dftq1&oqjno

The price hit 350

any progress?

https://goo.gl/vGZPQt&gowez

I feel like you have overlooked the political side of currency. Our currency actually belongs to the government so why would they allow the current system to change? Also, since the dollar is the worlds reserve currency, a lot of other nations support the dollar and its continued use far more than bitcoins.

https://goo.gl/QBk7DF&mysj

if 10,000 tiniest pieces of bitcoins are distributed via a phone or other type of electronic device the bitcoin could be distributed to anyone with a phone

2.5 billion without phones could then be BTC users

that’s 25 trillion mini pieces out of 11 million x 100 million bitcoin pieces [1.1 quadrillion] or about 2.5% of total bitcoins out there [which at 300$ a bitcoin x11 million bitcoins = 3.3 billion$] or $3.3 billion/40 = about 82.5 million dollars…chump change to apple and samsung and their service carriers….

until then it will be very limited in use except as something used to buy a currency or to teach trading at high schools

bitcoin may have to be piggybacked or trojan horsed into the mainstream or frontier/no man’s lands…through phones….

so, it is up to device and service creators

phones and phone services now cost too much a month or a day for the 2.5 billion without a phone or laptop

cheaper ‘service’ and ‘device’ needed in somalia, cuba, bangladesh and pitcairn…to name a few…

how many phones are out there?

now?

can a 5$ phone be created?

or will a bitcoin card have to do? swipes?

hmmmmmmm

colleges as place of introduction?

must be 18 to use?

https://goo.gl/vZCZ3D&jpiqo

TSU is a free social network that gives

the social revenues back to you. They instead focus on payments. It’s

the right thing to do. TSU gives you the ability to onboard your

audience by removing ourselves from the sign-up process. Everyone has

their own member short code, which is the door to their network.

It’s 100% free, TSU is completely free

and they share up to 90% of all network revenue directly to users. Why

do they do that? They believe that the greatest asset to any network is

you – the community. You are the creators, the artists, generators of

amazing content, and deserve to be fairly rewarded for it. We also

believe that a network is built from relationships which is why they

share as much of the revenue with as many people in the community. If

you want to join TSU right now then click the link below.

https://www.tsu.co/pitsikotsi

https://goo.gl/znPVUy&exof

Hello!

There is a new binary options platform running exclusively on bitcoins.

http://www.bitplutos.com/?campaign=10

What I found really interesting is that you can be totally anonymous while trading bitcoins – there is no verification for bitcoin users. The site is owned by eXclusive Ltd, the owner of eXbino.com platform in the industry since 2012, which is a financial liability guarantee.

Registration is free, so is the binary trading. All they require is a working email address and a password.

*Provide your valid phone number if you’re willing to get some live trainings/webinars/tips/trading strategies.

The methods of making a payment include bitcoin wallets of course, but you can also transfer fiat currencies via Skrill/Neteller/Wire that get converted into bitcoins with a current exchange rate. Everything is done live on the platform.

You can get a welcome bonus to your initial deposit. The more you deposit, the bigger bonus you get but usually bonuses range from 50 to 100% of your deposit. Obviously, you need to make a certain trading volume to cash out the bonus.

The platform is really responsive and fast. Its quotes are provided by the Thomson Reuters agency which is a guarantee of accuracy. You can trade over 90 different assets: currencies, stocks, commodities, indices and bitcoin-based assets (actually they have 9 at the moment). And the profits? You can really earn up to 80% per trade! And for all the unexperienced, their Account Managers provide thorough webinars/trainings, their Support Team is there for you 24/7 as well. Last but not least, they enable the Spot Follow feature which allows you to track other, better and more experienced, traders.

Sounds good? Then go for it – http://www.bitplutos.com/?campaign=10

https://goo.gl/KnJZFU&ysuh

EASYRECOVERY4@GMAIL COM To help you have it all recovered

To visit this article half a decade after its published, cements the fact that bitcoin is here to stay. Probably 5 more years and we will reach a stage where more people will see their jaws dropping about how Bitcoin has progressed. 2017, was a great year for bitcoin, and here we are in the middle of 2019, where FB is calling Crypto the INTERNET OF MONEY. Thanks to a better internet we know who were better with their entreprenuerial minds.