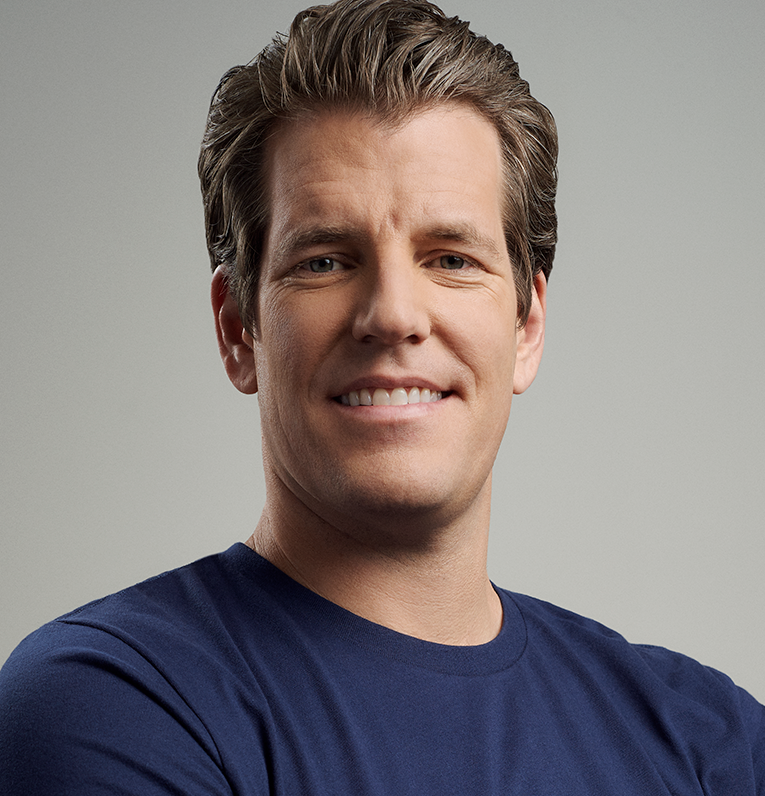

Cameron and I have been angel investors for over two years now. So far the journey has been incredible, we’ve met some of the most courageous, innovative and brilliant people along the way, but most importantly, we formed lifelong friendships that will persist regardless of the economic outcomes.

Today, our portfolio includes over 40 companies and is growing strong. But we always had a suspicion that one day we would go back to our roots as entrepreneurs and ultimately place a bet on ourselves. That day has come.

So with that, we are proud to announce Gemini: a next generation bitcoin exchange.

Read more about our journey here.

The more I think about the ‘front door’ / by the book approach you are taking wrt Gemini the more and more I think it will be hugely successful — credibility / trust is everything. The idea of pushing out an exchange before it is ready (to be first) is indicative of a ‘move fast and break things’ culture/mantra, which while a very effective strategy for finding PMF is the exact opposite tact that one should be taking when looking to be taken seriously in the world of finance, especially at the infrastructure level.

That said, the macro need for a secure/ trustworthy U.S. based btc exchange is clear, but the question that leaves me with is the micro ie what is the cost of security / trustworthiness and how does that map to transaction fees over time. In plain english, is the cost of security/compliance (trust) a variable that will fluctuate over time and if so how can it be maintained if transaction volumes lag over the short term.

These are just some thoughts, but this is how I would be thinking about things as an institutional investor that was on the sideline, but interested in dipping my toe in the water knowing that it will require time and $$ to develop a bitcoin strategy, which adds additional friction.

Have you considered repositioning bitcoins as a central bank currency? A finite supply of 21 million is pretty exclusionary of a universal currency or even a national currency but the IMF might find it useful particularly in light of the UN more or less being limited to sanctions.

I am a funded backer of your AngeLlist syndicate. Will you be syndicating an investment in Gemini?

Word is, it has not been easy gathering clientele to use your bitcoin platform. Well, customer service is paramount, and when I recently had a game-stopping issue in the sign-up process, your CSR “Shane” simply stopped answering my emails and put me on the ignore list. As of now, I am still not able to utilize your service. Because I had no choice but to abandon the whole thing and write it all off– just as was the treatment given to me. Show clowns like this the door, or this operation will never

truly prosper. Truly, you’re only as good as your weakest links…. Thanks for your time.

You have to listen to these brothers, they have had the Midas touch.

Gemini has the worst customer service that i have seen in a long time. They have no problem taking your money but when when you want to withdraw, it next to impossible. I have been trying to withdraw money from my account for almost a week now and everytime they deny it with vague one line responses and no effort to resolve the issues. I am only trying to withdraw money to the same account that i deposited it from. Whats so hard about that? In my latest interaction, they asked me to wire more money to them from a new account so they can “verify my account details”. Im starting to think that this is a ponzi scheme.

Why is it taking them more than 10 days to verify my address after I sent all of my documents? Wtf is wrong with them?

Satoshi Nakamoto, who may or may not be a real person, and his early followers in 2008, used distributed computers to employ blockchain methodology in order to validate transactions with bitcoin. They hoped this would free people and their transactions from the control and view of governments and central banks. We suspect, though, that the blockchain methodology on which crypto is based will ultimately have the exact opposite effect…

…, history and logic would suggest that eventually digital cryptocurrency will replace money as it currently exists. However, in this brave new world we suspect there will be significant differences from what Nakamoto and his followers envisioned. Everyone will have a blockchain wallet. All transactions and accounts will have digital identifying numbers. Blockchain methodology will insure against counterfeiting and other frauds by having a digital ledger of transactions that is transparent to the world. This is the utopia that bitcoin founders envisioned but before this occurs we suspect governments will take over the cryptocurrency universe. Then governments would ultimately know the exact real identity of all blockchain wallet owners, giving the government knowledge of all transactions. Governments and banks, central and otherwise, would then be the sole creators of the cryptocurrency and would control the amount outstanding…

https://seekingalpha.com/article/4136571

AKA “the mark of the beast.”

I hope you invested in plenty of lead in your portfolio.

The first step in how governments might get involved could involve cashing in on their names and status. Already there is a patent pending “Systems and methods for managing and processing transactions where legal tender status may be established for cryptocurrencies”. This would allow cash hungry governments at the national, state, and even local level to obtain income from cryptocurrencies without financial risk. Russia and Turkey have floated the prospect of a national cryptocurrency and Venezuela has actually launched one called the Petro. The price of one Petro is pegged to the price of one barrel of Venezuelan oil. The main purposes of the Petro were to evade sanctions and raise desperately needed cash. The Venezuelan government has already defaulted on debt so trusting Venezuela to honor its promise with regard to the Petro would seem no less risky than trusting it to pay interest on its bonds.

The challenge all cryptocurrencies face is attracting miners who use the crypto of choice for transactions, as a store of value, or as a speculative instrument. There is a need for each crypto to devise some feature that allows for a market share gain over others. It is presently unlikely that a crypto directly issued by a government or a central bank would receive immediate wide acceptance since the major original attraction of cryptos was that they were independent from governments or central banks. However, a crypto that had some element of legal tender status would clearly have a competitive advantage over its competitors.

We think the eventual replacement of paper money with a digital crypto could involve municipalities issuing what might be described as a put warrant. This is a security that gives the holder the right (but not the obligation) to sell a given quantity of an underlying asset for an agreed upon price on or before a specified date. A typical put warrant issued via blockchain methodology by a municipality would allow the holder to use specific cryptos to satisfy obligations to the government at a specified exchange rate, which is the strike price.

A example of such a transaction might be one in which a municipality issues a crypto put warrant with a market price of $1000 and a strike price of the warrant at $100. This gives the holder of the warrant the right to put to the government one unit of cryptocurrency and be credited with $100 as payment for taxes. This theoretical warrant is far out of the money and would likely never be exercised. The worst case for the municipality is that the crypto’s value falls to zero sometime in the future. This would cost the municipality $100 at some future date as the warrant reduces the holder’s tax burden by using one unit of cryptocurrency to satisfy all or part of its obligation to the municipal government. However, the municipality had initially received more than $100 in return for issuing the warrant so it will always benefit or at worst break even. The cryptocurrency that first aligns itself with a municipal government will likely be a winner during the period that the transition to a digital currency gradually occurs. That particular crypto would enjoy a first mover advantage in a new world monetary order.

https://seekingalpha.com/article/4178411

https://uploads.disquscdn.com/images/8a09c9305a14505a96ba3910170e848053ef0fff477a44cfd6f602dfdd0d39d0.jpg

Thank you for sharing the latest investment post, It is very helpful for inventors. Keep giving updates so that people can easily invest financially.

401k plan