Last week I gave an interview to CoinDesk about our recently launched Syndicate on AngelList. We covered some great topics in-depth, some of which include our long-term thesis on Bitcoin, bitcoin company investing and the crowd-funding venture capital model in general. I’ve posted the interview in its entirety below. Hope you enjoy!

-Tyler

1. Winklevoss Capital tweeted today to announce its AngelList syndicate. What new information was revealed today as part of the announcement?

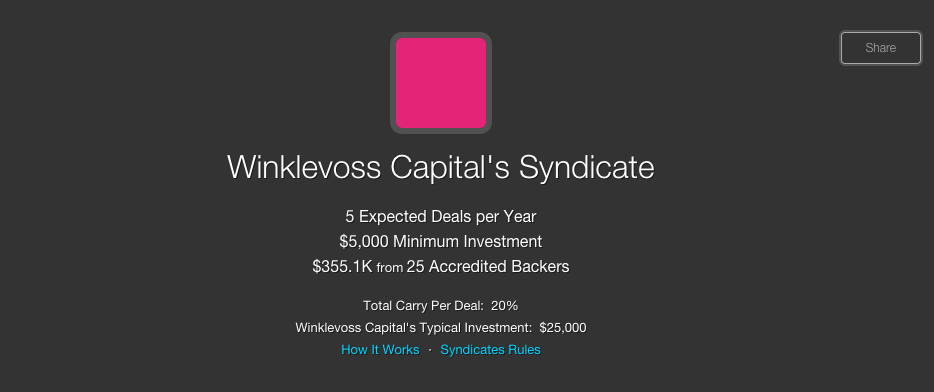

We just launched the Winklevoss Capital syndicate on AngelList* and have already started to syndicate our first deal. We plan to give accredited investors access to the types of deals that make up our existing portfolio. Not every company we invest in will be suitable for a syndicate nor will it always be possible for us to get an allocation to syndicate, but when it’s possible and appropriate, we plan to do so. Investors who “back” our syndicate ahead of time will get priority. It is important to note that “backing” does not obligate an investor to invest in the deals we syndicate.

*disclosure: Winklevoss Capital is an investor in AngelList.

2. The AngelList syndicate will focus broadly on tech deals. Do you plan to consider bitcoin companies? If so, what fields of interest might you be reviewing?

Absolutely. Our long-term thesis has been and continues to be that Bitcoin and blockchain technology are going to prove to be two of the most significant and pervasive technologies the world has ever seen. They will fundamentally change the way we transfer value, rethink the possibilities of trade, re-organize power and structure, and rewire the neurological pathways of the Internet forever.

Historically, a very small number of startups account for the majority of venture capital returns over a given period of time (e.g., Microsoft, Google, Facebook, Uber, etc.). We believe that a significant portion of the next decade’s venture capital returns will come from bitcoin and Bitcoin-related companies.

3. Of the five deals per year, how many do you expect to be in the bitcoin ecosystem?

The number five is just a placeholder, there’s a good chance we will be running more than five syndicates per year. It’s always hard to predict, but as I mentioned above, it is our belief that Bitcoin will be the most significant space in the future with regard to technology investments. As a result, we think there is a strong likelihood that our syndicate activity will reflect this.

4. More broadly Winklevoss Capital has been conservative about its investments in bitcoin companies. Why have you been hesitant or conservative with your backing of bitcoin companies?

Our goal as investors is to earn meaningful returns, not participation medals. Blindly investing in every Bitcoin company strikes me as the marketing /PR tail wagging the economic dog.

When we first looked at Bitcoin in 2012, we determined that the most important Bitcoin investment at that time was in bitcoin the asset itself. The best entrepreneurs and commercial technologists were just not in the space and in order to get them excited to jump in, the opportunity needed to be there first. As the opportunity in Bitcoin has grown from investment in and appreciation of bitcoin the asset, the top commercial technologists and entrepreneurs have poured into the space. Simultaneously, regulation (in general) has started to become clearer, which has set the stage for the infrastructure company layer to continue to be built-out and mature. The current venture investment opportunities generally remain in the core ecosystem (bitcoin the asset) and the infrastructure layer companies (e.g., merchant processors, compliance processors, vaults or storage systems, exchanges, miners, investment vehicles, tax reporting providers, etc.), but will eventually shift towards the application layer companies.

One of the most important variables to get right when investing is timing. To get this right, you need to have a clear view and understanding of the time ordering of things. Web 2.0 applications could not have been built (let alone have succeeded) before a critical mass of users had been on-boarded with broadband internet connections, which couldn’t have happened before infrastructure companies like Telecoms, Cisco, etc., built the routers and switches and laid the fiber that combined to form the backbone of the Internet. Facebook could not have come before Google and so on. The same is true for Bitcoin. The infrastructure layer will have to be built-out and mature before large-scale native bitcoin applications (beyond the single-user use case of “buy bitcoin” or “store bitcoin”) can really start to develop. When this happens it will get really exciting. We will start to see companies facilitating use-case scenarios that were simply not possible before the creation/emergence of Bitcoin. This application layer phase will really start to unleash the power of Bitcoin and blockchain technology.

5. What is your relationship with the investors in your syndicate? What are their thoughts on the bitcoin ecosystem and the opportunities therein?

The beauty of the AngelList platform is that it allows any accredited investor to reserve a spot in our syndicate regardless of whether or not we know them. Some of our backers we know offline but most of them we do not.

The goal of the syndicate model is to improve the power and efficiency of the marketplace. Geographical constraints are removed by syncing up of investors and entrepreneurs on a digital platform that otherwise may not have met. Liquidity, access and flexibility are increased on both sides of the market. It is a win-win for both investors and entrepreneurs alike.

In the digital world, funding should be a global process, not a local one. The crowd-funding model of venture financing is the future and we’re happy to be a part of it.

Our backers can message us at any time and we will do our best to respond. While we don’t know their thoughts on the bitcoin ecosystem and its opportunities first-hand, we imagine many of our backers are interested in Bitcoin and the other types of deals we have done and they look forward to taking a look at our overall syndicate deal flow in the future.

6. In your speech from Money2020, you laid out a broad vision for bitcoin, one that stretches beyond the infrastructure investments we’re seeing today. Does Winklevoss Capital intend to invest to help being these ideas to market?

The short answer is yes. As investors we’ve already invested in infrastructure companies like Xapo, which is providing vaulting services; Filecoin, which is working on developing Bitcoin-like blockchain protocols; and a few other Bitcoin infrastructure and financial companies that are still in stealth-mode.

We’ve also invested in Authy, a two-factor authentication provider that is heavily used by companies in the Bitcoin space like Coinbase to ensure security of their user’s accounts. Matternet, another portfolio company, is creating a transportation network for drones, which may in the future be hired and paid for with bitcoin.

We plan to continue to look for compelling infrastructure layer and application layer companies that will continue to pave the way for our larger vision of bitcoin.

7. Going forward to 2015, how will Bitcoin factor into the larger strategy of Winklevoss Capital?

As previously mentioned, Bitcoin already is and will continue to be a major part of the overall Winklevoss Capital strategy for the next decade and beyond.

big ups. great post. love the message.

Thanks Andy!

Do you consider social tipping (with off-blockchain high velocity transactions) as a new app layer use-case? Seems to be low-hanging fruit which is gaining some traction/visibility; I could see a future where every web platform builds this in natively, supplementing or even replacing altogether stars/gold/likes.

Absolutely! Social tipping is the coolest native Bitcoin application I’ve seen in a while, very excited about it!

What is the best way to touch base with someone in charge of investments at Winklevoss before signing up for AngelList? We are on our second venture and believe it is very fundable. We also believe that investments are just as much about the personal connection, as it is the product. We’d love to get face time. Here’s a recent article on our latest venture from Town & Country: http://www.townandcountrymag.com/style/fashion-trends/a2388/club-preppy/ – Thanks – Katherine MacLane [email protected]