There has been talk for sometime about a potential bubble in Silicon Valley. With China’s stock market cratering to an 8-year low and US equities pulling back, a possible downturn (and potential silver lining) seems like it could be on the horizon.

This got me thinking. If a bar metaphor can be used to articulate a Nash equilibrium in game theory, then maybe we can find a similar metaphor to describe markets with plentiful capital.

While not a perfect match, the qualities of an open bar seem to capture the spirit of a marketplace inundated with cheap capital. It goes something like this:

1) A frothy market is like a party with an open bar.

2) The bar (i.e., marketplace) is overcrowded by patrons (i.e., investors) because drinks are free (i.e., low interest rates).

3) Bartenders (i.e., entrepreneurs) can only handle so many patrons at a time (i.e., room on a cap table is limited). As a result, many serious patrons don’t get served (i.e., are unable to invest in a deal). Instead, they are pushed out of the way and drowned out by the noise.

4) Despite this, tips (i.e., high valuations/fundings) are plentiful because patrons have more cash to burn than ever; none of them are paying for their drinks anyway, and everyone is vying for the Bartender’s attention.

A few things happen as a result:

a) Bartenders don’t have an immediate need to differentiate between serious patrons and bandwagon patrons.

b) Bartenders recognize they are being tipped regardless of how well they do their job, and complacency sets in with some of them.

c) The tipping gold rush incentivizes bandwagon bartenders to enter the market, lowering the overall quality of bartenders, further increasing noise and decreasing signal.

5) This can’t go on forever. When the clock strikes twelve (i.e., market downturn/correction) and the bar starts charging for drinks again (i.e., higher interest rates), utility curves are traveled leaving only the truly committed patrons standing (at least for the time being ;-), while the bandwagon patrons run for the exit.

6) The bar becomes much less crowded and serious patrons have a much better chance of being served.

7) Bartenders who built relationships with bandwagon patrons will find their tip base (i.e. valuation/funding) erode, if not evaporate, whereas the tip base of bartenders who built relationships with serious patrons will be less affected.

8) Bartenders who remain complacent will no longer be tipped for their poor service.

9) The bar’s profit is no longer prepaid or seemingly guaranteed — Its profit is now a function of supply and demand for its services.

10) Incompetent bartenders will be fired as their performance is now more closely tied to the profits of the bar.

11) Experience improves all around; this party just got much better.

TL;DR: Free drinks have a price.

I’m curious to hear what you guys think!

Fortunately, at the end of the day, Partender tracked all of this :)

Haha in all serious, I love the post!

– Nik

Fortunately, at the end of the day, Partender tracked all of this :)

Haha in all serious, I love the post!

– Nik

Thanks Nikhil! Glad Partender was there to save the day! lol

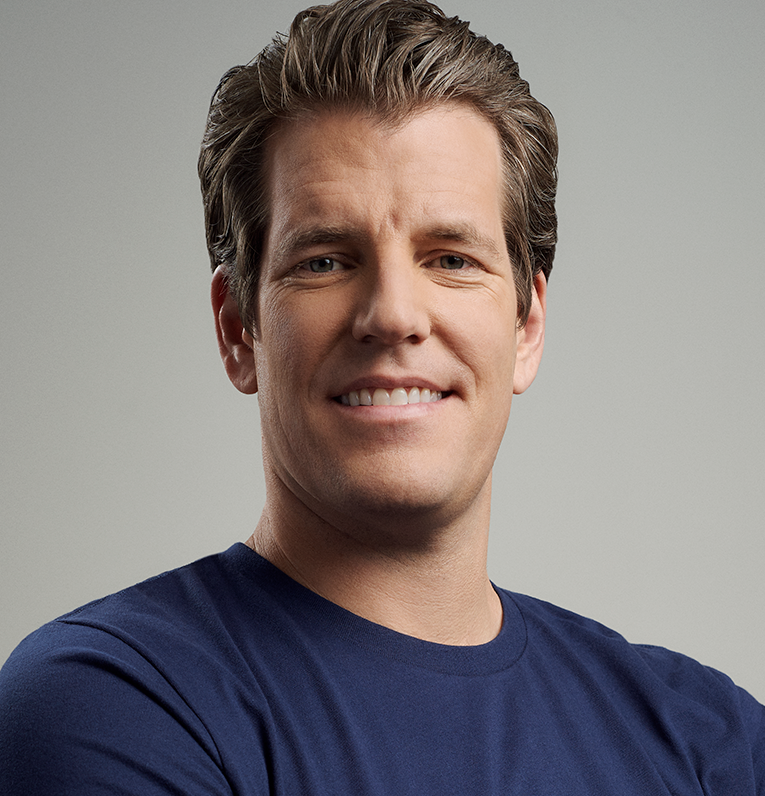

Hi Tyler! I’ve been searching for hours for an e-mail address to contact your office. Is there any way of contacting you?

with this , Nik wins the concise mini plug on vc thread award for this week! *slow clap*

Very interesting analogy. Bottom line is that it’s best to keep your eyes and ears open and not judge too quickly. While many people come on board when the party is jumping, the people that are there when it’s not as “cool”, but see the potential are the ones that ultimately have the best time and or get the highest ROI ;)

Complacency in the market, Enough Said. Go Genisis Go!

Don’t drink and drive! Great post.

This post sums it up!

Silicon Valley no longer interested in ventures that returns

a couple million dollars year after year, on a million dollar investment.

They all after Uber type of valuations.

It is like a freemium VS a premium model for education, games and events. Patrons who go after free are less invested.

The trick for bartenders is to spend time deciphering who the real patrons are – provided they have the luxury of time to do so in the first place.

Any way to get support on our new Business? https://eurobitmarket.com

The competition is good when the competition is good.

I think of the blockchain eWallet rush personally more alike the gold rush days; it is mostly amateur work by opportunists with no long-term vision digging up the environment with no thought of sustainability.

They will be squeezed out as the gimmick subsides and its shown they bring no value. I get that eWallets make transactions more accessible but besides a handful of the best, I feel that current companies are misjudging their worth. I feel that without the exchange component in making bitcoins more accessible, the mediocre ones are just noise.

Back on the gold rush analogy, the big players will turn that gold into jewellery and eventually conductive circuitry. That’s when the blockchain will shine and the 22nd century form of money will properly be realised. It’s a beautiful future that I cannot wait for.

The clip you’ve posted isn’t a Nash Equilibrium. Each person has an incentive to deviate back to the attractive blonde.

Very nice! =) The only difference I see is that the free vs non-free drinks in this scenario are a matter of arbitrary decisions where the bar has full control over the decision, whereas the interest rates in the market place may be more or less market driven, the Fed doesn’t possess full control over market rates, except for the Fed Funds rate for interbank lending.

Fair analogy, but is a bar where you want to find a one-night stand, or your wife? Let’s go to the after party. I see your glass is empty. http://alike.one

Thanks for sharing this post. Amazing. Look what I found here: http://www.sargamchoudhary.com/20-cute-preppy-outfit-ideas-2017/

Try Me! Open Bar @www.acebooks.xyz!

With that you dont mean the $COIN Party 😉

The SEC decision was not a big surprise. What makes me wonder is how you are still trying to force BTC into Stock Exchange.

Are your intentions going astray? The purpose of crypto currencies was never their eligibility for use at stock exchange.

Therefore BTC is not a equivalent in terms of what the internet community wanted, a independent currency, global, secure, reliable, accessable.

As result, the BTC is not in full compliance with the values of the global internet community.

BTC has been a mere vessel for what the internet community was looking for.

It is time to think about that, and how important a global platform for crypto currencies has become.

Our capital markets are weird though, because demand for debt increases WITH higher issuance.

Bulding a marketplace for cryptocoins, startup etc. Check out the domain name marketcap.com, which is for sale.

Tyler, nice allusion in the article but you missed one aspect.

—How are the relationships (Patron to Bartender and perhaps even Bartender to Bartender) changed, irrespective of interest rate fluctuations when one of the Bartenders owns the Bar??

I like the aspect with the tips. However, I think consequences of rising interest are more severe. Bad bartenders forced out of business will also harm their suppliers, their employees and their communities (less taxes, more subsidies). This could leed to a downturn of the entire economy.

..and that is why I stay sober. :)

Aalberto Cedeno

Executive Chairman, President & CEO

Aacebooks & Co.

Wesla.co, TX

(@ acebooks.xyz !)

And low interest rates also collect a plenty of not taken place companies, serious patrons most likely will not go to such (bar) .

Вместе with by the goods increase both its value and quality for the consumer. You can improve consumer characteristics, and can make simply more « dear packing » as very dear brand.